-

Jobs Report

Bruce Steinberg

Employment Expert | Research | Corporate Communications

Mobile home page | Non-mobile home page

Monthly Jobs Report

February's Employment Report follows this opening comment ...

Con Te Partiro...

Not to bury the lead, this is my last newsletter ... I'm retiring.

But, why use a few words, when many more will do?

In December 2002, I left Staffing Industry Analysts not necessarily to

strike out on my own, but to take a breather to see what else life had to

offer. Eventually, a few projects came in over the transom, I started this

newsletter, and eventually secured a few clients. The first edition of this

newsletter was published on September 1, 2006, as I lamented that Pluto had

been demoted from planet status by a consensus of astronomers. In that first

newsletter, we drew a parallel to what could be considered "normal job

growth" and what to expect from the labor market should also change, mainly

due to a shift in population demographics.

So

it's been almost 20 years and who is going to give me a gold watch?

Honestly, who needs one today and I have my father's a 25-year gold watch

that he received in 1967. I don't wear it but it still keeps excellent time

if I wind it, but I digress.

So

it's been almost 20 years and who is going to give me a gold watch?

Honestly, who needs one today and I have my father's a 25-year gold watch

that he received in 1967. I don't wear it but it still keeps excellent time

if I wind it, but I digress.

I am not participating in what is currently being called the "Great

Resignation" caused by the pandemic because my decision was pretty much

determined when I was born. As I mentioned in that first newsletter there

was massive population shift expertly documented nearly two decades earlier

by U.S. Department of Labor?s Employment and Training Administration, along

with the Hudson Institute landmark study of the changing American workforce

"Workforce 2000: Work and Workers for the 21st Century" published in 1987. A

follow-up report "Workforce 2020 -- Work and Workers in the 21st Century"

was published in 1997.

IMHO, the pandemic has been a catalyst to the evitable.

When predicting workforce and labor trends in "Workforce 2000" for the

following 15 years and presenting possible public policy issues that would

arise, the authors discussed, among other matters: Improving the dynamism

of an aging workforce ... Reconciling the needs of women, work, and families

... Integrating Blacks and Hispanics fully into the workforce ... Improving

workers' education and skills.

BTW, there is a recent movement by some scientists arguing that Pluto should

be reclassified as a planet. What is old is again relevant in both

cosmology and labor market trends. Still don't accept this premise? Last

Friday Tears for Fears appeared on one of the late night talk shows with

their 1985 classic "Everybody Wants To Rule The World". Apparently -- and I

fact-checked this -- the original phrase was "everybody wants to go to war".

Actually, I lied a little -- I'll continue to look at economic and labor

market trends that interest me and will periodically publish those thoughts

via my Twitter account. Furthermore should an interesting project/s --

preferably one-off or possibly ongoing -- come across a different transom

since I now live in the mountains of western North Carolina, I'll consider

it.

As for my more

immediate plans, time

to go hiking with the pup.

Bruce out.

[This space intentionally left blank.]

Not so q

uick recap

The unemployment rate declined 0.2 percentage points to 3.8 percent in February as a result of more people employed and fewer people unemployed. Obviously, that's no great insight, but the size of the labor force did not growth too much and the number of those not in the labor force declined. For more detail see the Household Survey section below. Interesting sidebar: it has been almost exactly two years for the number of initial claims for unemployment insurance to return to below its pre-pandemic level. See our Twitter for a very interesting chart.

Overall nonfarm job growth was up and by significant amount. In February, total nonfarm jobs increased 678,000 compared to an increase of 481,000 in January and 588,000 in December. A year ago in February 2021, this metric was up 710,000

Average hourly wages were up only one cent in February 2022 after much larger increases in recent months; from February 2021 to January 2022, the average increase was 14 cents. Average hourly wages are up 5.1 percent in February 2022 from February 2021.

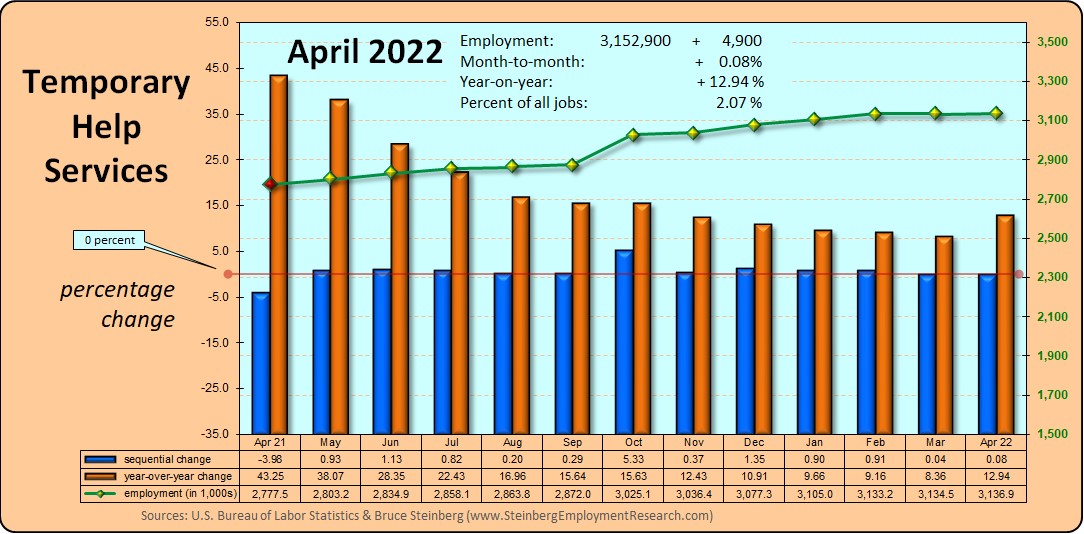

Temporary Help Services continued to increase, which translates into a new zenith. And with the December 2021 data finalized by the Bureau of Labor Statistics, we can report that 2021's increase was larger than 2020's decrease. See the Temporary Help Services section below.

Jobs Report

Private sector employers added 654,000 in February after adding 448,000 in January; a year ago the private sector added 693,000 in February 2021.

The private Goods-producing sector added 105,000 jobs in February after gaining 24,000 in January, which was preliminary reported last month as a 4,000 increase.

-

Manufacturing growth gained 36,000 in February after adding 16,000 in January.

-

The Construction sector was up 60,000 in February after adding 7,000 in January, which was initially reported as down 5,000 in last month's BLS employment report.

-

Mining and logging was up 9,000 in February after adding 1,000 in January, which as first reported as down 4,000.

The private Service-providing sector was consistent with a gain of 549,000 in February and that was an improvement from the 424,000 the sector added in January.

-

Hiring activity slowed in the Retail trade sector that added 36,900 jobs in February after increasing by 69,200 in January.

-

The Wholesale trade sector regained some traction with an increase of 18,300 in February after adding 12,300 in January.

-

Transportation and warehousing continued to add jobs at only a slightly slower pace with an increase of 47,600 in February compared to the 51,100 it added in January.

-

Financial activities crushed it with a gain of 35,000 jobs in February after adding 3,000 in January.

-

The Professional and business services sector picked up some momentum with an increase of 95,000 in February after adding 73,000 in January. Computer systems design and related services computed in only 4,500 more jobs in February after adding 8,200 in January. Management and technical consulting services added 9,500 jobs in February that followed an increase of 10,800 in January.. Architectural and engineering services gained 4,400 jobs in February, which followed a 8,700 increase in January.

-

The entire private Education and health services sector was up 112,000 in February. Hiring managers must have been really feeling the heat at Home health care services by hiring at a feverish pitch by adding 19,700 jobs in February after eliminating 1,500 jobs in January..

-

The entire Leisure and hospitality sector was up 179,000 in February after adding 167,000 in January.

The total number of Government jobs was up 24,000 in February. The Federal government was flat, state government was up by 3,000, and local government increased a total of 21,000 jobs with much of that increase in education.

Temporary Help Services Roundup

In February, THS added 35,500 jobs and that works out to a sequential increase of 1.1 percent and a year-on-year gain of 9.6 percent. This translates into 3,146,200 THS jobs in February 2022, which is the most temporary help services jobs ever.

(if the charts are unclear, click on them to open in a browser window)

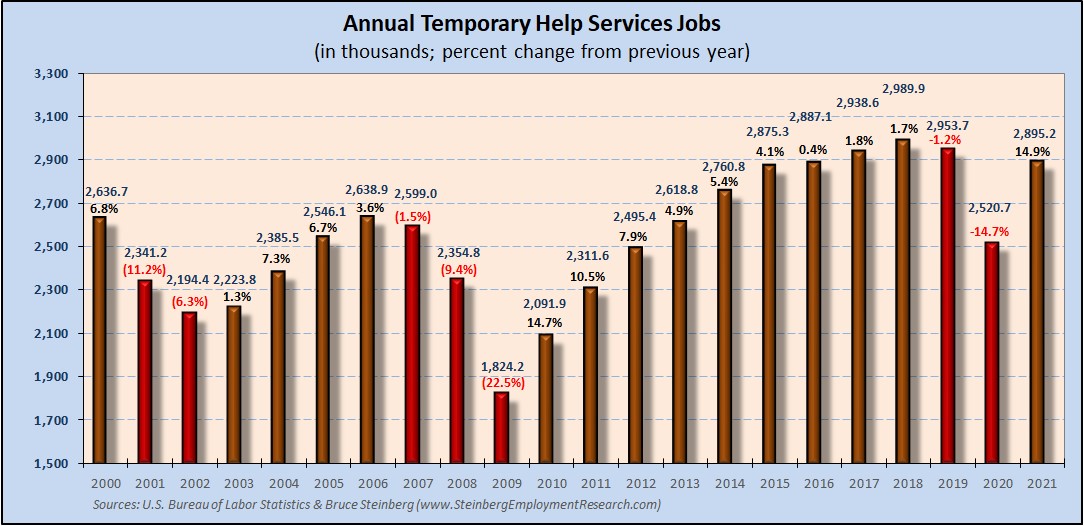

Now that the December data have been finalized, -- which is why we continued with our newsletter until this month before retiring (see above) --THS increased 14.9 percent in 2021 compared to a 14.7 decrease in 2020. As impressive as that improvement may appear, THS services was back to 2016 in its job count in 2021.

In February, temporary help services market share, or its portion of all jobs, was 2.0919 percent and this is an all-time high. It was 2.0777 the previous month and a year ago in February 2021, it was 1.9970 percent and two years ago in February 2020 it was 1.9054 percent.

The unemployment rate declined to 3.8 percent in February from 4.0 percent in January. The last time it was this low was right before the pandemic hit two years ago.

In February, there were 548,000 more employed persons and 243,000 fewer unemployed persons than in January. Since the labor force only expanded by 304,000, the unemployment rate declined. But perhaps more interesting and significant was that those not in the labor force declined by 183,000 that could mean that some people who left the labor force are coming back to join the party..

Both the labor force participation rate inched up 0.1 to 62.3 and the employment-population ratio also increased by 0.2 to 59.9.

We will continue to maintain an updated table of many major employment as well as other general economic indicators here or here for the mobile version.

Non-mobile site

SteinbergEmploymentResearch.comCopyright (c) 2005-2023

. All Rights Reserved. Bruce Steinberg